Tax Time: Understanding Your W-2

Every year, as tax season approaches, we receive many questions from employees about W-2s. That’s why we created a guide that answers the questions we receive most often and helps you better understand your W-2.

First, an important date:

• Employers have until January 31 to complete W-2s, as stipulated by the IRS.

Tip for Anthros Client Employees: Anthros, as a Professional Employer Organization and payroll provider, prepares a Form W-2, Wage and Tax Statement, for the employees of our clients. The easiest and fastest way to access your W-2 is electronically through our secure, online employee portal at AnthrosInc.com. Through the employee portal, employees can view, download and print their W-2s for preparing their tax returns.

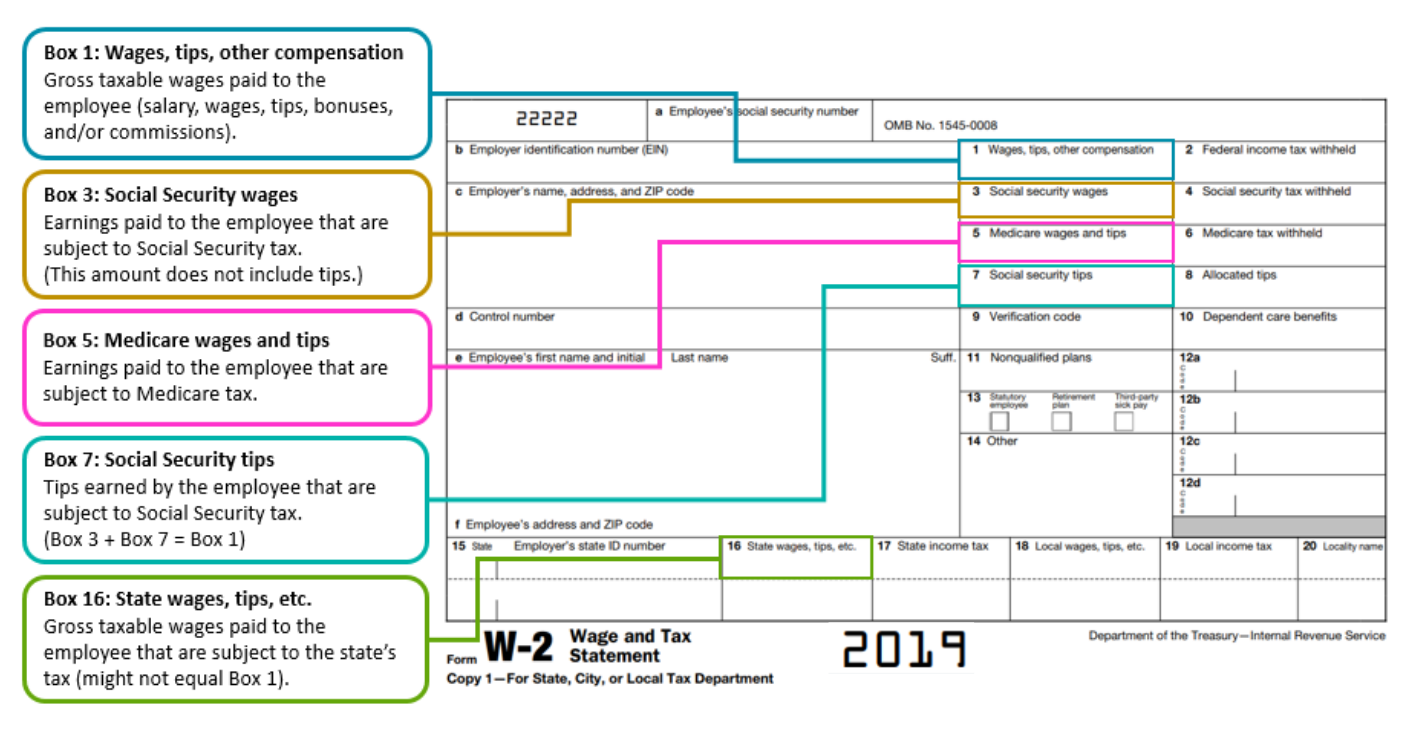

Guide to Understanding the Income Boxes on Your W-2

Whether or not you are preparing your own tax return, it’s important to have a solid understanding of the W-2 and what each of the income boxes mean.

Why Are Wages on Your W-2 Different from Wage Amounts on Your Last Pay Stub?

These are the three most common reasons why the wages on your W-2 may differ from the amount shown on your last pay stub.

1. Company Health Insurance is a Pre-Tax Deduction

This is the most common reason for your pay stub earnings to be different from your W-2. If your company offers pre-tax health insurance and you have participated, then the taxable wages in Boxes 1,3, 5, and 16 will be lower by the amount of the pre-tax health insurance deduction.

2. Company-Sponsored Retirement Plan Participation

These types of plans, such as a 401(k), will reduce the taxable federal and state wages only, which are reported in Boxes 1 and 16.

3. Earnings Included Non-Taxable Income Items

Non-taxable income items include reimbursements for mileage or another type of non-taxable expense that was paid back to you through payroll. These non-taxable items will lower gross taxable wages in Boxes 1, 3, 5, and 16.

What Health Insurance Reporting is Required?

Update on the law: The Federal Tax Penalty for not being enrolled in health insurance has been eliminated.

The 1095-C is a form your employer provides to you about employer-provided health insurance coverage. You do not need to provide this to the IRS and can file your current taxes without it. Keep the document for your records. If asked about health care coverage, answer to the best of your knowledge. No documentation will be required.

What Should You Be Thinking About for Next Year?

This is a good time to review your filing status for next year’s tax return. If your marital status has changed, number of dependents has changed, or you need to adjust the number of allowances claimed, remember that you must make these changes through your employer.

Not sure what your filing status should be? Visit the IRS and answer a few quick questions through their Interactive Tax Assistant to determine your filing status.

If you are an Anthros client employee, remember that you can easily change your filing status at any time through our secure online Employee Self-Service portal at AnthrosInc.com.